Telecom M&As: How Clintworld Migrations Create More Value Than Any Other Approaches

Delve in the transformative power of the Clintworld Migration. Discover how it’s reshaping the landscape of telecom mergers and acquisitions, and setting a new paradigm for strategic decision-making in the telecom industry.

Despite backlash from various regulatory watchdogs, the telecommunications sector continues to witness a relentless wave of Mergers and Acquisitions (M&As). This phenomenon has become an indespenable strategic tool for operators seeking to expand their reach, optimize resources, and enhance their competitive edge.

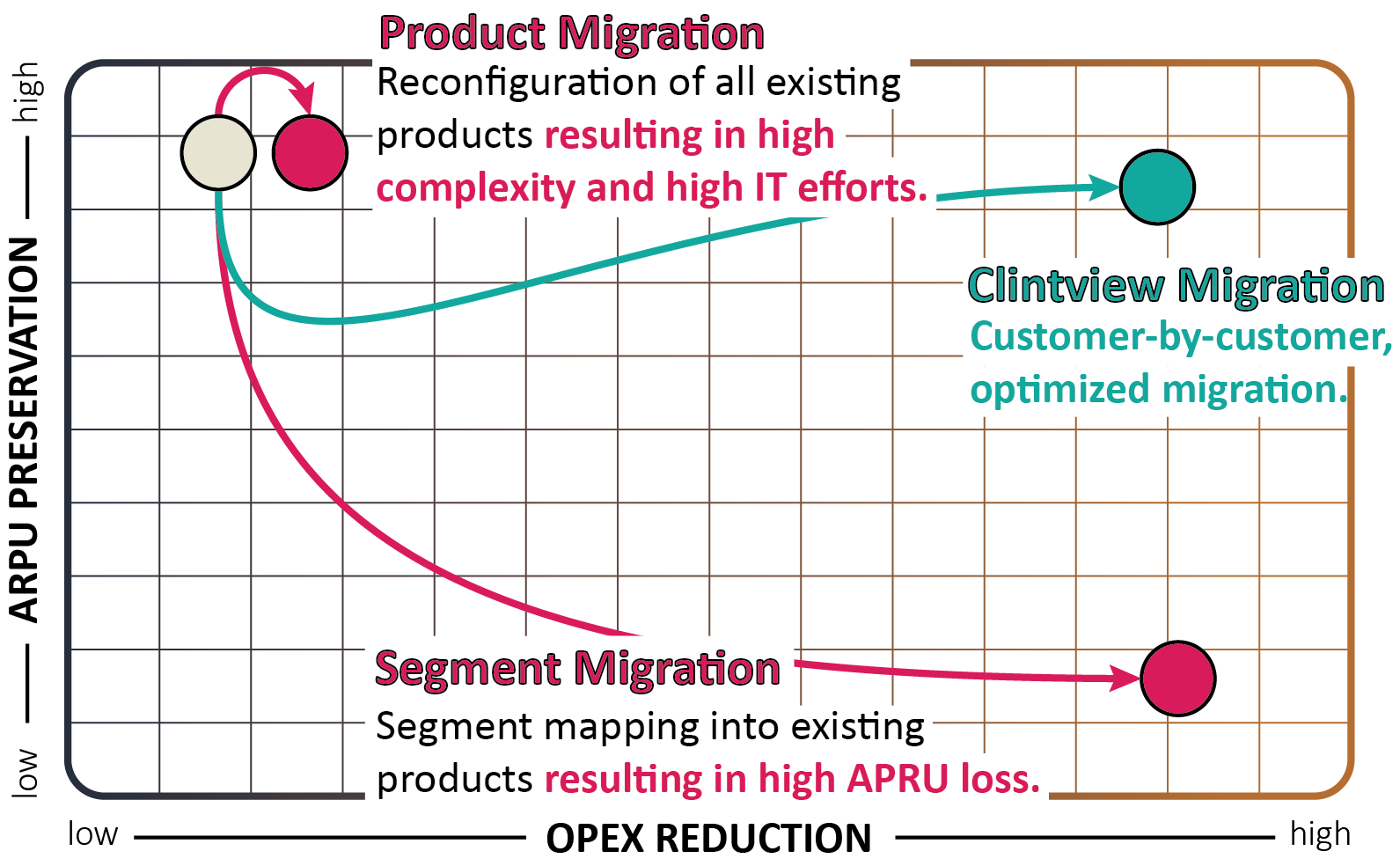

Within this context, we’ve categorized the three major migration methods used to navigate the complex challenges presented by M&A activities: Product Migration, Segment Migration and a Clintworld Migration. The choice of migration method often defines how effectively operators can manage the transitional period and streamline their operations post-merger. In many cases, telecom firms, lacking the necessary tools and expertise, opt for either a Segment Migration or a Product Migration as their primary strategies. These approaches, while common, often lead to a period of turmoil and the need for significant cleanup efforts in the aftermath of the merger.

However, amid this myriad of approaches, the Clintworld Migration stands out as a beacon of innovation and customer-centric value creation. Operators who embrace the Clintworld Migration approach set themselves apart, driving synergies, minimizing disruptions, and ultimately paving the way for unparalleled growth and success.

In the following examples, let’s delve deeper into the intricacies of these various migration methods for integrating two operators within the context of an M&A, shedding light on the strategies, challenges, and benefits associated with each approach. Through this exploration, we aim to provide valuable insights into how telecom companies can navigate the dynamic landscape of mergers and acquisitions while striving to deliver superior service and value to their customers.

What is a Product Migration?

In a Product Migration, teams are tasked to consolidate all existing price plans, options and discounts from both merging operators into a single, comprehensive portfolio.

The aim is to retain both customer bases by minimizing the immediate impact on Average Revenue Per User (APRU) though the continuation of both product portfolios offered up to this point. With a same-for-the-same approach, customers continue using familiar products and services, ultimately reducing the likelihood of churn.

However, the trade-off comes in the form of higher Operational Expenditure (OPEX). Managing a bloated portfolio requires extensive resources for maintenance, support and marketing efforts—especially if both OSS/BSS systems are kept running at parallel. The complexity of such a diverse range of offerings can strain operational efficiency and resource allocation, leading to an exponential increase in costs in the long run.

While the Product Migration may initially mitigate revenue losses, it can hinder the potential for cost saving and optimization that could have been achieved through a streamlined process from the get go.

Upside: Little APRU loss.

Downside: High OPEX cost.

Whats a Segment Migration?

Contrasting with the Product Migration approach, a Segment Migration involves a more aggressive migration strategy. Instead of accommodating all existing price plans, options and discounts, customers are coerced into transitioning to an entirely new portfolio, carefully designed to align with market conditions, operational efficiency, long-term objectives.

While this approach may result in a notable APRU loss due to the discontinuation of certain familiar products and services, the reduced complexity of the new portfolio enables substantial cost savings in terms of OPEX. The streamlined portfolio simplifies operational processes, optimizing resource allocation, and overall efficiency.

Although the Segment Migration initially poses challenges related to customer dissatisfaction and potential churn, the long-term benefits lie in the cost savings and operational effectiveness achieved through this approach.

Upside: Reduced OPEX cost.

Downside: Probable ARPU loss, high dissatisfaction.

What a Clintworld’s Optimized Migration Does Right

Clintworld’s Clintview software simulates the best price plan, option and discount for each customer using a detailed set of rules that balance APRU loss and customer satisfaction—among other factors.

Setting a new standard for precision and customization, this groundbreaking technique employs a complete evaluation of alternatives in the entire product portfolio that takes into account an array of multidimensional factors. These factors include customer usage patterns, payment punctuality, hardware preferences, churn rates, margin calculations, and ARPU protection.

Unlike the other migration styles, Clintworld Migration offers a granular, customer-by-customer best-tariff calculation. What truly distinguishes this method is its ability to differentiate between seemingly similar customers, assigning them unique price plans tailored to their specific behaviors and preferences. This meticulous analysis ensures that even customers who appear alike are given personalized treatment based on an intricate web of data.

In essence, Clintworld Migration brings forth a level of precision previously unattainable, minimizing both ARPU loss and OPEX costs by optimizing the customer experience and operational efficiency.

Upside: Reduced ARPU loss and OPEX costs.

It’s Never Too Late to Optimize

In the wake of a merger and acquisition in the telecommunications industry, it’s essential to recognize that it’s never too late to optimize the telecom tariff portfolio. While the initial integration phase may be challenging and filled with complexities, the dynamic nature of the telecom sector allows for ongoing adjustments and refinements.

As customer preferences evolve, technology advances, and market dynamics change, telecom operators can seize opportunities to fine-tune their product offerings. By staying agile and responsive, they can ensure that their product portfolio remains aligned with the evolving needs of their customer base, maximizing revenue potential and enhancing customer satisfaction—all while making efforts to eliminate harmful legacy tariffs in a bloated portfolio.

A Proven Track Record

To fully embrace the transformative power of a Clintworld Migration and deliver an exceptional experience to your customers, the indispensable key lies in adopting a comprehensive solution like Clintview. It’s an all-in-one solution that empowers telecom operators to craft and deliver product pricing experiences so personalized that they seem almost magical. It is this level of granular customization and precision that sets Clintview apart as a catalyst for success in a merger and acquisition landscape.

Here are some of the impactful results that telecoms have experienced with Clintview:

In the case of each of these successful migrations, namely Virgin Media O2, Telefónica, Vodafone, and PhoneHouse, we managed to streamline and remove over 10,000 different product and option combinations. Our exceptional performance resulted in a 100% success rate in cleaning up the designated portfolios, with highly overachieving ARPU-retention rates that surpassed client expectations.

Telefónica reached 99.99% tariff prediction accuracy in their E-Plus merger using Clintworld. → See our Success Story for more information.

Want to join our happy customers?

Clintview is not just a technology solution; it’s a game-changer for telecom operators navigating the intricate landscape of mergers and acquisitions. By leveraging customer data in Clintview, operators can not only optimize their migration strategies but also ensure a level of personalization and service quality that borders on the magical. The results achieved by telecom leaders such as Virgin Media O2, Telefonica, Vodafone, and Phone House serve as compelling evidence that Clintview is the tool of choice for those committed to achieving unparalleled success in the ever-evolving telecom industry.