Making the Most of an MNO/MVNO Relationship

In recent years, the relationship between MNOs and MVNOs has become increasingly important, as MVNOs are able to offer competitive pricing and innovative services to consumers without having to invest in expensive infrastructure. However, for MVNOs to succeed, they need to have a strong relationship with their MNO partners and understand how to leverage their capabilities to maximize their offerings.

So, Who’s Who in the Telecommunications Industry?

Mobile Network Operators (MNOs) and Mobile Virtual Network Operators (MVNOs) are two types of entities that play a crucial role in the telecommunications industry. While both provide communication services to their clients, MNOs own and operate the cellular infrastructure, while MVNOs lease network capacity from MNOs to offer mobile services to their customers.

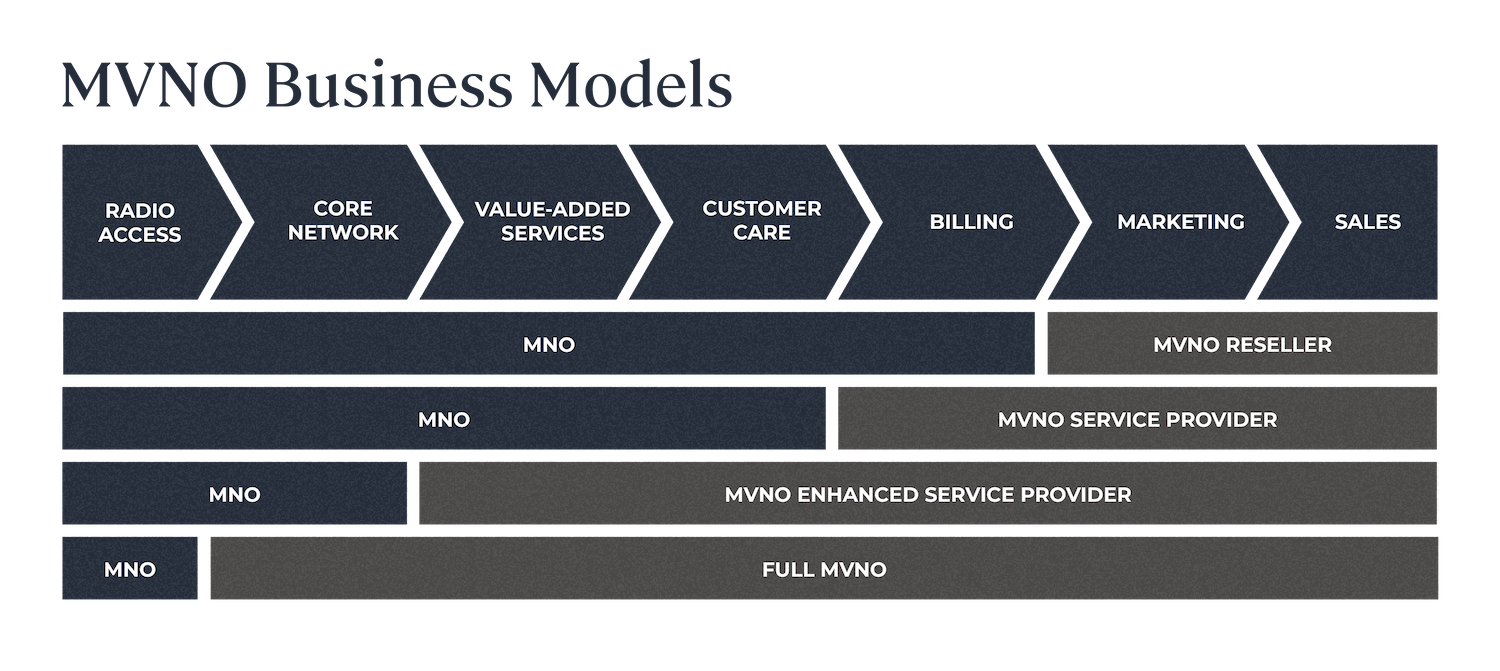

So where MNOs are fully independent with their service offerings, MVNOs are dependent on MNOs so they can fully function. This relationship, and the spectrum of network elements provided, is where we can find distinctions between one MVNO and another:

With a higher volume of service offerings and an expanded range of prices, options and discounts, there’s no doubt Mobile Virtual Network Operators (MVNOs) provide an immense value to the mobile telecommunication industry as a whole.

But with fierce competition comes compromise, which begs the question, is there a role Mobile Network Operators (MNOs), who own the telecommunications infrastructure, can play to make cooperation with MVNOs more feasible or even desirable?

Let’s take a look into some powerful tactics that can help leverage this partnership.

Advantages of a Tag-Team Duo

With the MVNO market size projected to grow from USD 64.0 billion (2019) to USD 89.0 billion (2024), it’s no surprise every MNO wants a piece of the action. Where some markets see very few MVNOs (Finland 2-3), some have oh-so-many (Germany 200+).

So what’s in it for the MNOs?

For a symbiotic ecosystem to exist, a set of conditions related to scale, economics and service development must be met in order for an MVNO to thrive. These characteristics include:

- Increase Market Share:

Creating an MVNO can provide a new revenue stream for an MNO without the same level of investment required to build out their own network. By leasing network capacity to an MVNO, an MNO can generate revenue from unused or underutilized network capacity while still maintaining control over the network. - New Market Expansion:

Many key market players are choosing MVNO partnerships as growth strategies to broaden their local customer base or further expand their presence abroad.

Such examples can be found in the middle east, where STC Kuwait and Virgin MEA are teaming up to launch Virgin Mobile Kuwait (Connect Arabia) using STC’s network:

“The two companies aim to provide an unparalleled customer experience in this market, transforming the user and on-demand experience for pre-paid mobile users through a range of digital solutions. Virgin Mobile Kuwait aims to launch its app-based platform mainly targeting the local youth population.” [source]

Here we see STC gaining new market share, the local youth, while Virgin expands to a new market. - Segmentation:

An MVNO can offer a different set of services, features, and pricing plans than the MNO. This can help an MNO fill gaps in their offering and cater to specific market segments that they may not have been able to target previously.

For example, an MVNO could offer more flexible or affordable pricing plans, specialized services like IoT connectivity or machine-to-machine communication, or enhanced customer service offerings.

In some situations, segmentation is inescapable. When France’s Iliad ventured into the Italian market in 2018, they drastically undercut the competition. Two out of the three leading MNO’s at the time created supporting MVNO’s, called fighter brands, to remain competitive. With Vodafone’s new MVNO, Ho and TIM’s MVNO, Kena, the MNO’s could finally keep up against Iliad without hurting their flagship brand. [source] - Distribution:

Creating and/or partnering with an MVNO can increase brand awareness and recognition for an MNO. By leveraging the MVNO’s marketing and distribution channels, an MNO can reach a broader audience and potentially attract new customers who may not have considered their network previously. This can ultimately lead to increased revenue and market share. - Tech Diversification:

As smaller entities, the nimble and agile characteristics of an MVNO can be utilized when adopting new technologies such as Internet of Things (IoT), Machine-to-Machine (M2M), connected cars, smart homes, etc., which can not only improve time to market but attract a brand new assortment of customers.

This can be seen in the strategic MVNO relationship between automaker Jaguar Land Rover and french MNO Transatel that aims to clear the path for 5G-connected automobiles. In an interview, Transatel’s CEO Jacques Bonifay explains,

“When we speak to car manufacturers, we always tell them that in the long term they need to become telecom operators, as it’s strategically vital for them to be able to control the connectivity ecosystem around their vehicles. Why? Because there are soon going to be so many apps running in a car – some managed by the car manufacturer, others by the driver, some by the passengers and still others managed by third parties, such as the driver’s insurance company.” [source]

Although some MNOs may initially view MVNOs as a threat to their market share, the reality is often quite different. In fact, many MNOs leverage their partnerships with MVNOs to protect their brand identity and maintain their mass market share, while also exploring new niche markets and non-traditional channels.

MVNOs can be particularly useful for breaking into highly saturated countries or stimulating mobile data adoption and usage among specific segments. This is because smaller players enjoy the distinct advantage of greater agility, enabling them to respond more quickly to new market opportunities.

On the other hand, MNOs are often larger beasts and can be slower to respond to changing market conditions. By working with MVNOs, however, they can access a wider range of differentiation strategies beyond just price differentiation. These razor-sharp differentiation strategies help them stand out in a saturated market, ultimately benefiting both MNOs and MVNOs alike.

Difficulties In MNO/MVNO Cooperation

Coordination is a crucial aspect of maintaining a successful relationship between MNOs and MVNOs, and it can be a significant challenge. One of the key issues that arise is the potential for rival price plans and products to cannibalize revenue from established offerings on the market.

Even among cooperating MVNOs, there can be a tendency to offer similar products at competing prices, which can create confusion and ultimately lead to customer churn. This can happen when MVNOs try to differentiate themselves by offering unique pricing models, promotions, or features, which may overlap or clash with those offered by other MVNOs or the MNO itself.

Moreover, the MNO may also introduce new products or services that compete with the MVNOs’ offerings, which can further complicate the relationship. This is especially true when the MNO views the MVNOs as a threat to its market share and seeks to limit their growth.

To address this challenge, MNOs and MVNOs need to work closely together to coordinate their pricing and product offerings, avoid overlap, and prevent cannibalization of each other’s products. This requires clear communication and a commitment to align their strategies, as well as a willingness to adapt to changing market conditions. Moreover, having access to appropriate tools can aid in developing razor sharp differentiation strategies to distinguish themselves even in a highly-saturated market.

Clintworld Leads the Way on MNO/MVNO Symbiosis

Clintworld’s pricing analytical engine, dubbed Clintview, enables MNOs to calculate millions of price, option, discounts—even those of their competitor. It’s a perfect tool to shape the profit maximization opportunity for both MNOs and MVNOs on any market.

Clintview accomplishes this by:

- Cutting costs:

With Clintview, MNOs analyze past, current and potential pricing options, discounts, and promotions that can help them to offer more attractive deals via MVNOs without sacrificing their own profitability. This can help to reduce costs and increase revenue for both MNOs and MVNOs.

- Pin-point forecasting:

Clintview uses advanced algorithms and data analytics to provide simulated environments for various ‘what if?’ scenarios. This calculation of different price options and promotions can help MNOs to plan and adjust their best offerings (or the best offerings for their MVNO counterpart) based on anticipated demand from current market conditions.

- Considering the competition:

Clintview takes into account the pricing and promotions of both MNO and MVNO competitors, allowing MNOs to adjust their own prices and promotions accordingly. This can help MNOs to stay competitive and attract more MVNOs. - Cannibalization check:

When an MNO introduces a new pricing option or promotion, it’s important to consider how it will impact existing offers. Clintview can help MNOs to analyze the potential for cannibalization, or the risk of existing customers switching to the new offer. - Product recommendations:

Clintview can also help MNOs to identify which products or services are likely to be the most popular among MVNOs. This can help MNOs to tailor their offerings to better meet the needs of MVNOs and increase their chances of success. - Improved decision-making:

By providing comprehensive data analysis and insights, Clintview can help MNOs to make better-informed decisions about pricing and promotion strategies. This can lead to improved profitability, increased market share, and better relationships with MVNOs.

Market segmentation is critical to this, as it enables the MVNO to identify opportunities that may be under exploited by existing providers. But there are probably fewer and fewer opportunities to target low price offers, particularly in heavily saturated markets. That means MVNOs should at least consider markets that attract a typically higher ARPU and ways in which they can introduce services that can be sold as extras to basic packages.

An MVNO Success is an MNO Success

To an MNO, an MVNO can act as a strategic enabler, that they may not be able to service effectively themselves. It is, of course, in both parties interests that the venture is successful.

The MVNO does something that the MNO cannot do, while the MNO brings network coverage and service quality: it’s a nicely symbiotic relationship. When considering their strategy, MVNOs should think about how their service can deliver something that the host MNO cannot, as this can bring enhanced benefits for all and support such a fruitful relationship for the future.

It’s about dancing to their own tune without stepping on each others toes and Clintview is there to help.