2G/3G Sunset: Risks, Challenges and Opportunities for Telcos

As the world moves towards faster and more advanced mobile networks, the time has come for 2G and 3G to retire. Winding down legacy network services is a necessary step towards freeing up spectrum and resources for newer technologies like 5G. While this may seem like a straightforward process, there are a number of challenges and considerations that need to be taken into account.

2G/3G Sunset and How to Prepare

As operators plan for the future, they must carefully balance the need to invest in newer 4G/5G technologies while also winding down legacy services like 2G/3G. It is done not only to free up limited spectrum—a physical constraint for service providers trying to roll out new cellular services—but reinforce infrastructure that will power a faster, more resilient 4G LTE and 5G network, currently being deployed all over the world.

Moreover, pressure from European National Regulatory Authorities (NRA’s) will call for an involuntary sunset of 2G/3G technologies at various stages. For telecommunication providers, this will require a strategic approach that takes into account the unique challenges and opportunities of each market, or else face the consequences of a failed 2G/3G sunset.

Problems That Occur With a 2G/3G Sunset

While phasing out legacy network services is a necessary step towards the future of mobile networks, it does come with a set of considerations:

- Compatibility Issues: Some devices still rely on 2G/3G, and sunsetting these networks will render them obsolete or incompatible with newer networks. Such technologies include internet of things (IoT) or machine-to-machine (M2M) services, such as smart home meters, payment readers, ATMs and e-call systems⏤just to name a few.

- Coverage Gaps: In some areas, 2G/3G may still be the primary mobile broadband platform. Sunsetting may leave these areas with coverage gaps and poor connectivity. Operators must communicate clearly with their customers about the changes and provide support to help them transition to newer technologies when they roll out.

- Network Congestion: As 2G/3G networks are phased out, more users will be forced to rely on newer technologies, which may lead to network congestion and slower speeds until newer networks are fully deployed and optimized. Operators must carefully plan their customer migration to ensure they are coordinating their network upgrades with the right technologies at the right time.

Success depends on finding the right balance between migrating B2B and B2C customers while maintaining low customer churn in a competitive environment, careful consideration of strategic value propositions and staying aware of looming deadlines.

It may sound simple, but there’s a lot at stake.

Risks of a Failed 2G/3G Sunset

The risks associated with a failed 2G/3G sunset can have significant consequences for telecommunication operators.

- Loss of Revenue: One of the primary risks is the potential loss of revenue from customers who are still using these networks. If the sunset occurs too quickly or without proper planning, operators may not have the necessary infrastructure in place to support these customers, leading to a loss of revenue.

- Negative Impact on Brand Reputation: In addition to financial losses, a poorly planned 2G/3G sunset can also have a negative impact on the operator’s brand reputation. Customers may become dissatisfied with the quality of service or the lack of support, leading to negative reviews and word-of-mouth criticism. This, in turn, can harm the operator’s image and make it more difficult to attract new customers.

- Regulatory Issues: Another risk associated with a failed 2G/3G sunset is regulatory issues. Operators may face legal and regulatory issues if they do not properly communicate the sunset to their customers or fail to meet certain requirements for phasing out legacy networks. This can result in fines or other penalties, as well as further harm to the operator’s reputation.

Operators must balance the need to free up resources for newer technologies with the need to maintain coverage and connectivity for their customers, while proper communication can help to minimize financial losses and prevent negative impacts on brand reputation.

Sunsetting any network is a complex process, however, the added spectrum and resources can pave the way for faster, more advanced mobile networks that will benefit customers and operators alike. Therefore, it is essential for operators to carefully plan and execute the 2G/3G sunset to mitigate these risks and ensure a smooth transition.

How Should a Telco Prepare for a Sunset?

As the looming deadline to sunset legacy 2G/3G networks comes to a close, its important for Telcos to be prepared for these changes. Here’s how:

- Evaluate the current portfolio: Service providers should evaluate their current portfolio to identify which products and services are impacted by the sunset. This evaluation should include an assessment of the impact on customer experience and the overall revenue stream. By understanding the impact, marketers can develop a comprehensive plan that mitigates any negative effects on the business.

- Know the dates that affect deployments: The next step for Telcos is to be aware of the dates that will affect deployments. This includes knowing the sunset date and any associated milestones. Being informed about these dates enables marketers to make informed decisions about marketing efforts, communication, migration campaigns, and promotions.

- Create a migration plan: After evaluating the portfolio and understanding the dates that affect deployments, Operators should create a migration plan. This plan should detail how customers will be transitioned from the legacy technology to the newer technology. The plan should also include a communication strategy that keeps customers informed about the changes and how it will impact them.

- Simulate these changes: Simulating a migration plan before executing can be incredibly beneficial for Telcos. It allows them to identify potential issues and risks before they occur, giving them the opportunity to mitigate these problems before they cause any significant disruptions to the network or customer experience. Additionally, the use of product rules and business rules can help Telcos optimize their migration plan and ensure that they are making the most effective use of their resources. By taking the time to simulate the migration plan beforehand, they can ensure a smoother transition to newer technologies, minimizing downtime and disruption for their customers.

- Set up fast or cascade migrations: Depending on the allotted time, Operators may need to set up fast or cascade migrations. Fast migrations involve quickly migrating customers to new tariff plans. Cascade migrations involve migrating a small number of customers at a time, monitoring the process, and gradually increasing the number of migrations to help identify and resolve issues before a full migration.

By following these steps, Operators can minimize the impact on customers and the business while ensuring a smooth transition to newer technologies.

Run the Best Migration and Pruning Project with Clintview

As 4G and 5G networks expand and become more sophisticated, it’s likely that we’ll see an increase in legacy sunsets in the years to come, leading to more impactful migration and pruning decisions. So, why not incorporate the right strategies into your own sunset project from the get go?

Clintworld’s Clintview software is all-in-one expert simulation and analytics software built for telecom companies — powered by an advanced proprietary algorithm — to deliver truly personalized tariff recommendations for each and every customer. Learn more about how Clintview can make your migration project a breeze:

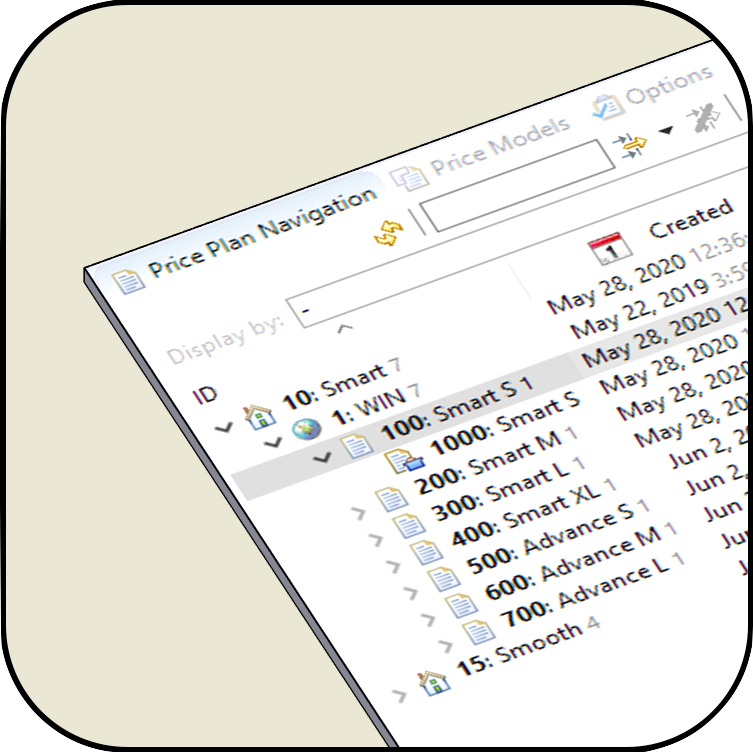

1. Configure Your Price Plans

Clintview is seamlessly integrated with your billing software, ensuring correct utilization and interpretation of your data across the entire platform. This enables a comprehensive comparison of your entire portfolio of price plans, options, and discounts which can even include those of your competitor.

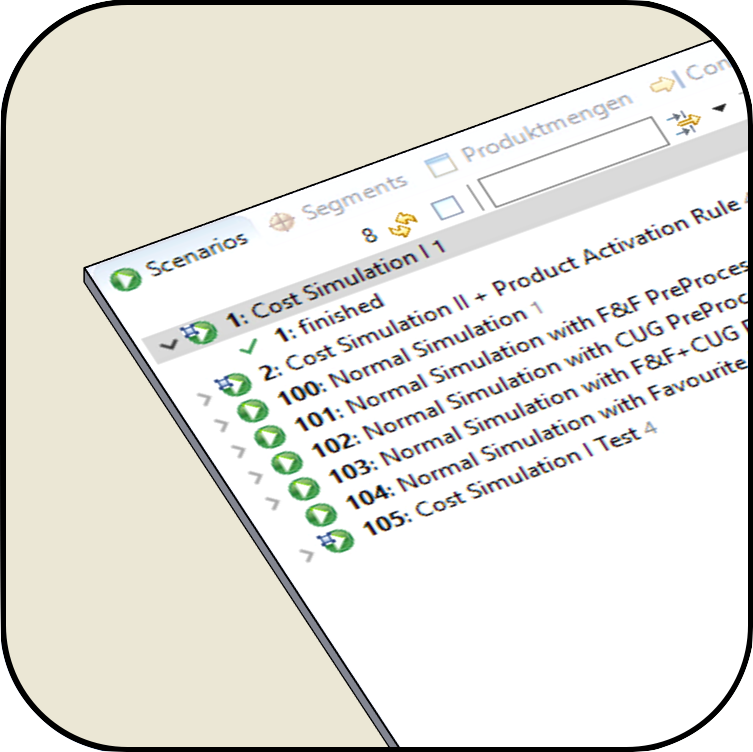

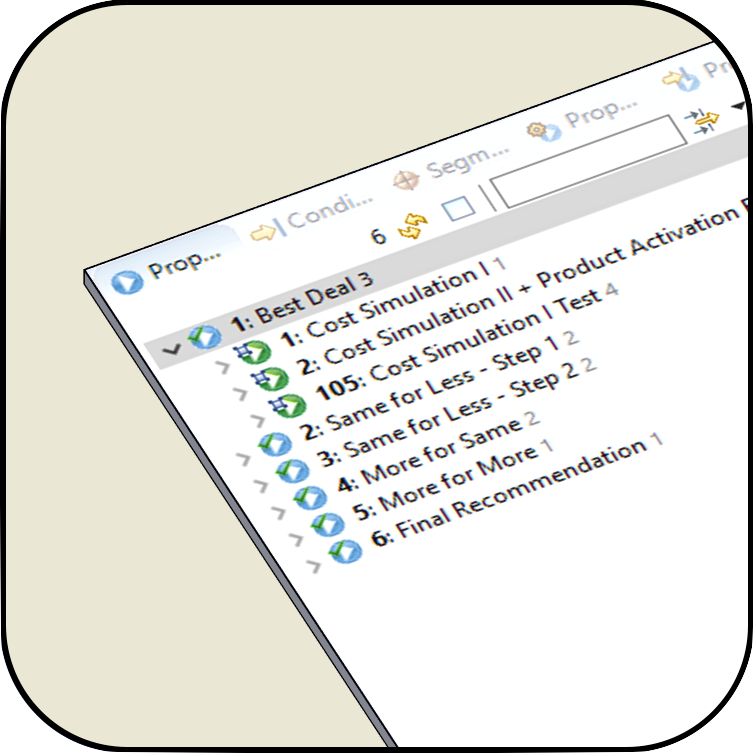

2. Run a Best Tariff Simulation

Clintview’s simulation engine computes results for hundreds of price plan-option-combinations for every subscriber in the selected customer segment. The number of results can be reduced using Conditions, Decision Functions and Scenario parameters. Several simulations for different purposes can be configured.

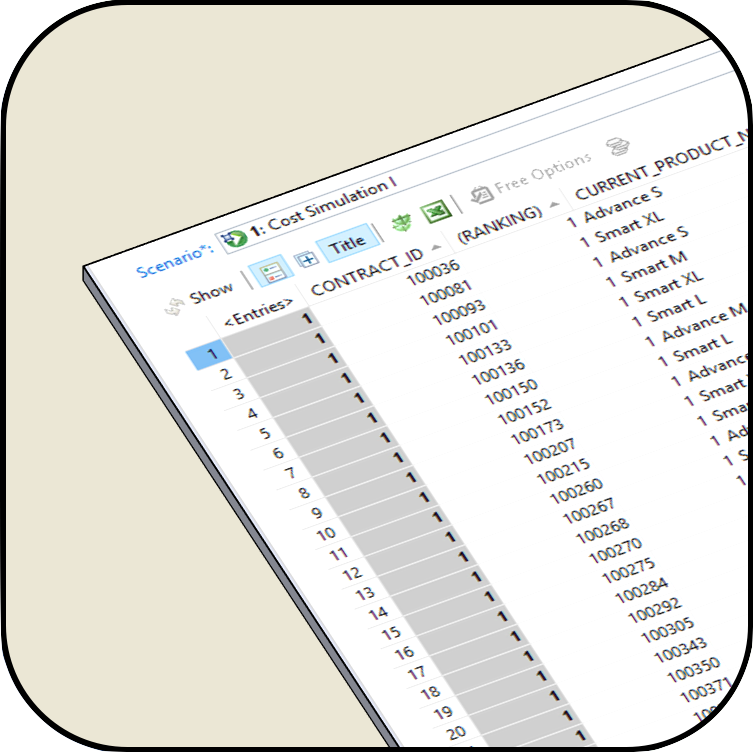

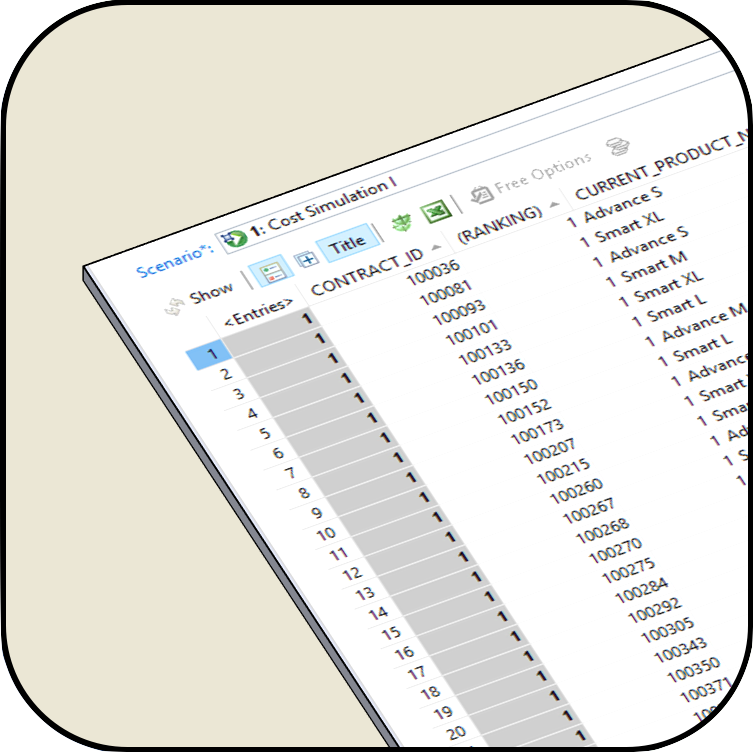

3. Analyze Your Top Results

As a fully automated solution, Clintview requires minimum OPEX to deliver relevant, consistent and automated results. Contract-by-contract, customer-by-customer with a proven track record of large operators beyond 20 million subscriptions, this is a solution that scales.

4. Export The Offer You Need

Use these insights across any channel to boost the performance of your portfolio. The inclusion of their contract, usage and options, provides such granular customization that helps consumers know and trust that they’re being given the best deal.

5. Built For Automated Scale

As a fully automated solution, Clintview requires minimum OPEX to deliver relevant, consistent and automated results. Contract-by-contract, customer-by-customer with a proven track record of large operators beyond 20 million subscriptions, this is a solution that scales.

When Are Sunsets Happening in Europe?

The process of phasing out 2G and 3G networks is underway, and it marks a significant milestone in the evolution of mobile telecommunications in Europe. Here’s a glimpse of when and where they’re happening.

So far, the DACH telcos have opted to remove their 3G network but keep 2G as a fallback for B2B customers using IoT/M2M applications, and B2C customers, even through reduced voice quality and longer connection times are to be expected.

Following in DACH’s footsteps, Czech Republic performed a quick shutdown, 2G is left as backup for now.

Many of the Nordic countries are keeping 2G to blanket hard-to-reach areas.

Orange opted for a 2G sunset and then a 3G sunset in France, and flipped the script in their other markets, i.e. Belgium, Luxembourg, Poland, Romania, Slovakia and Spain.

| Country | Operator | 2G Sunset | 3G Sunset |

|---|---|---|---|

| Austria | A1 | N/A | N/A |

| Magenta Telekom | N/A | 01/01/24 | |

| Drei | N/A | N/A | |

| Belgium | Proximus | 31/12/27 | 31/12/24 |

| Orange | 31/12/30 | 31/12/25 | |

| Telenet/Base | 31/12/27 | 01/09/24 | |

| Bulgaria | A1 | N/A | N/A |

| Yettel | N/A | N/A | |

| Vivacom | N/A | N/A | |

| Croatia | Hrvatski Telekom | N/A | N/A |

| A1 | N/A | N/A | |

| Telemach | N/A | N/A | |

| Czech Republic | T-Mobile | 2G as backup | Off as of 01/11/21 |

| O2 | 2G as backup | Off | |

| Vodafone | 2G as backup | Off as of 31/03/21 | |

| Denmark | TDC | 2G as backup | Off as of 31/12/22 |

| Telenor | 2G as backup | 01/04/23 | |

| Telia | 2G as backup | Off | |

| 3 | N/A | Off | |

| Estonia | Telia | 2G as backup | 31/12/23 |

| Elisa | 2G as backup | 31/12/23 | |

| Tele2 | N/A | 31/12/25 | |

| Finland | Elisa | 2G as backup | 31/12/23 |

| Telia | 2G as backup | 31/12/23 | |

| DNA | N/A | 31/12/23 | |

| France | Orange | 31/12/25 | 31/12/28 |

| Altice France (SFR) | 31/12/26 | 31/12/28 | |

| Bouygues | 31/12/26 | 31/12/29 | |

| Free Mobile | N/A | N/A | |

| Germany | Deutsche Telekom | 2G as backup | Off |

| O2 / Telefónica | 2G as backup | Off as of 29/12/21 | |

| Vodafone | 2G as backup | Off as of 01/07/21 | |

| Greece | Cosmote | 2G as backup | Off as of 10/21 |

| Vodafone | 2G as backup | Off as of 06/22 | |

| Nova | 2G as backup | Off as of 10/06/22 | |

| Hungary | Telekom | 2G as backup | Off |

| Yettel | N/A | Off as of 07/22 | |

| Vodafone | N/A | Off | |

| Digi | N/A | N/A | |

| Ireland | Three | N/A | 31/12/24 |

| Vodafone | 2G as backup | Off as of 01/02/23 | |

| eir | N/A | N/A | |

| Italy | Wind Tre | N/A | N/A |

| TIM | N/A | Off as of 15/10/22 | |

| Vodafone | N/A | Off as of 28/02/21 | |

| Iliad | N/A | N/A | |

| Fastweb | N/A | N/A | |

| Latvia | LMT | N/A | 31/12/25 |

| Tele2 | N/A | N/A | |

| Bite | N/A | 31/12/27 | |

| Triatel | N/A | N/A | |

| Lithuania | Tele2 | N/A | 31/12/25 |

| Telia | 2G as backup | Off as of 31/12/22 | |

| Bite | 31/12/28 | 31/12/25 | |

| Mezon | N/A | N/A | |

| Luxembourg | Orange | 31/12/30 | 31/12/25 |

| Tango | 2G as backup | 01/01/24 | |

| POST | 2G as backup | Off as of 31/12/22 | |

| Malta | Epic | N/A | N/A |

| GO | N/A | N/A | |

| Melita | N/A | N/A | |

| Netherlands | T-Mobile | Off as of 01/06/21 | N/A |

| KPN | 31/12/25 | Off as of 31/03/22 | |

| VodafoneZiggo | 31/12/24 | Off as of 04/02/20 | |

| Norway | Telenor | 31/12/25 | Off |

| Telia | 31/12/25 | Off | |

| Ice | N/A | N/A | |

| Poland | Orange | 31/12/30 | 31/12/25 |

| Play | N/A | N/A | |

| Plus | N/A | N/A | |

| T-Mobile | 2G as backup | 31/12/23 | |

| Portugal | MEO | N/A | N/A |

| NOS | N/A | N/A | |

| Vodafone | N/A | N/A | |

| Romania | Orange | 31/12/30 | 31/12/25 |

| Vodafone | N/A | N/A | |

| Digi | N/A | N/A | |

| Telekom | N/A | N/A | |

| Slovakia | Orange | 31/12/30 | 31/12/25 |

| O2 | N/A | N/A | |

| Telekom | N/A | N/A | |

| Slovenia | Telekom | 2G as backup | Off as of 30/09/22 |

| A1 | 2G as backup | 30/06/23 | |

| Telemach | N/A | N/A | |

| T-2 | N/A | N/A | |

| Spain | Movistar | N/A | 31/12/25 |

| Orange | 31/12/30 | 31/12/25 | |

| Vodafone | N/A | N/A | |

| Yoigo | N/A | N/A | |

| Sweden | Telia | 31/12/25 | 31/12/23 |

| Tele2 | 31/12/25 | 31/12/25 | |

| Telenor | N/A | N/A | |

| Tre | No 2G Network | 31/12/25 | |

| Switzerland | Swisscom | Off | 31/12/2025 |

| Sunrise | Off | 31/12/2026 | |

| Salt | N/A | N/A | |

| United Kingdom | Virgin Media O2 | N/A | N/A |

| EE | 31/12/2025 | 31/12/2024 | |

| Vodafone | 31/12/2033 | 31/12/2023 | |

| Three | 31/12/2033 | 31/12/2024 |